Welcome to The Monthly!

Markets entered 2026 grappling with another wave of geopolitical stress and policy uncertainty. Efforts to revive Venezuela’s energy output, the Fed being issued subpoenas by the DOJ, and tariff threats on an assortment of European countries by the Trump administration all heightened short-term volatility.

As we have emphasized consistently, investors should stop overreacting to geopolitical noise and return to the disciplined work of measuring and mapping the six key macro cycles that determine momentum and dispersion within and across asset markets—growth, inflation, monetary policy, fiscal policy, liquidity, and positioning.

Growth, inflation, and liquidity are already acting as tailwinds, while fiscal policy is highly likely to turn supportive in 2026—potentially helping markets navigate elevated volatility stemming from historically crowded bullish positioning.

Monetary policy remains a wild card, especially with the nomination of Kevin Warsh—a known hawk—as Fed Chair. Our research was already calling for no change in monetary policy this year based solely on our economic outlook and the latest forward guidance from members of the FOMC.

Warsh’s contentious nature and strong desire for dramatic reforms at the institution may derail the outlook for monetary easing altogether if the incumbents at the Fed dig in to defend their broken models and legacy of policy mistakes. Stay tuned.

In Case You Missed It

Are Portfolios Prepared for a Productivity Boom?

On Fox Business, Darius joined Maria Bartiromo to explain why a structural uptrend in U.S. productivity is becoming the dominant macro force for markets.

The US economy is likely transitioning from a trend 2% productivity regime toward a trend 3% productivity regime—a shift that historically has coincided with stronger equity returns and faster corporate profit growth.

Should Investors Stay Overweight Equities Into 2026?

On BNN Bloomberg, Darius joined Merella Fernandez to explain how markets remain supported by an alignment of key macro cycles.

Chart of the Month

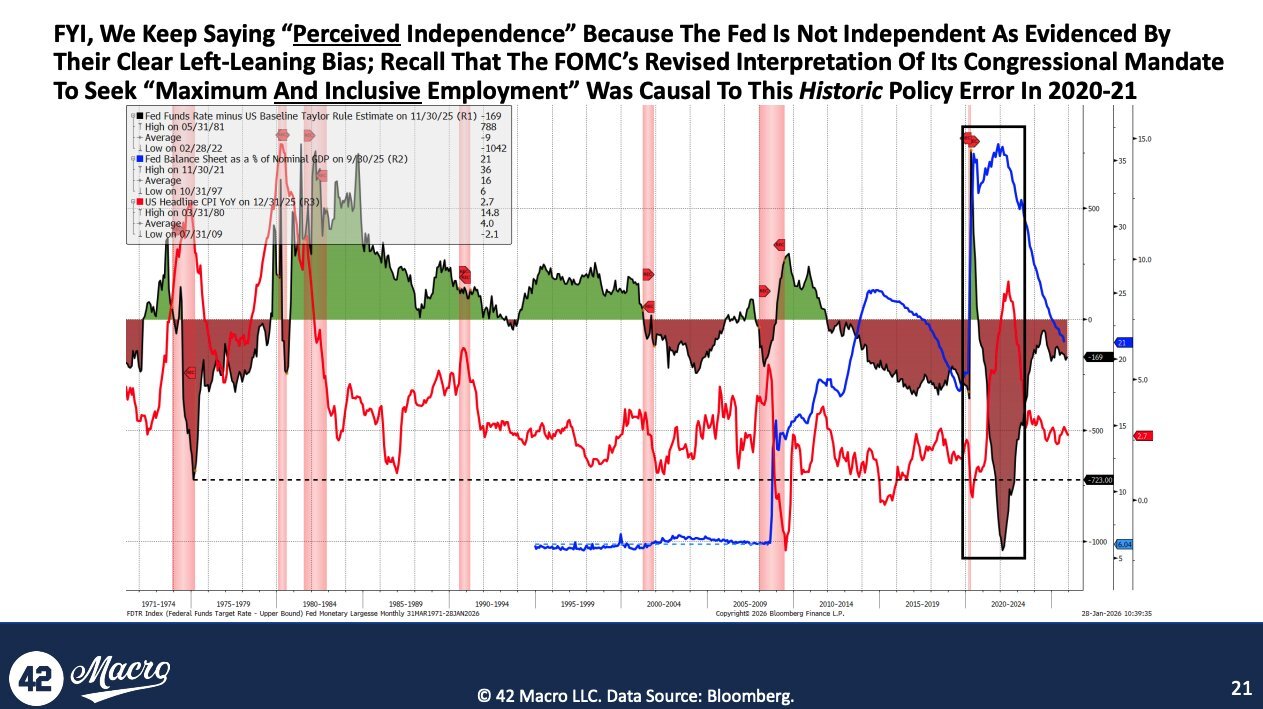

FYI, We Keep Saying “Perceived Independence” Because The Fed Is Not Independent As Evidenced By Their Clear Left-Leaning Bias; Recall That The FOMC’s Revised Interpretation Of Its Congressional Mandate To Seek “Maximum And Inclusive Employment” Was Causal To This Historic Policy Error In 2020–21

The narrative in the media and across global Wall Street that the Fed is a politically independent institution and the victim of politicized attacks is just that—a narrative. Sure, the Fed is currently a victim of politicized attacks, attacks that we strongly disagree with. Central bank independence is non-negotiable for any advanced society to function well.

But the aforementioned narrative still represents a convenient story concocted by the incumbent US monetary policymaking cabal to distract the public from its legacy of policy errors; most notably the error that contributed to the ongoing nationwide affordability crisis and K-shaped economy.

The lack of accountability (e.g., blaming the pandemic and Russia’s invasion of Ukraine for the 40-year high in inflation) and unwillingness to explore meaningful reforms (e.g., abandoning the broken Phillips curve framework, backward-looking “data dependency”, and noisy overcommunication) among members of this cabal is simply un-American.

Trust The Process: Successful Signals From Dr. Mo

Discretionary Investment Ideas Summary: Tuesday, October 31, 2023

On October 31, 2023, our Discretionary Risk Management Overlay signaled a bullish breakout in Gold $GLD. Since the pivot, $GLD has appreciated 142%.

As always, we’ll be back next month with updated insights on all things 42 Macro.

— Team 42