What Are The Key Risks To Asset Markets In 2025?

Darius recently joined Maggie Lake to break down the key risks to asset markets in 2025, the outlook for inflation, investor positioning insights from the 42 Macro Positioning Model, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Are The Key Risks To Asset Markets In 2025?

We believe 2025 will be a year in which the distribution of probable economic outcomes is both wide and widening. This is largely driven by an anticipated series of significant changes to fiscal and regulatory policy.

Specifically, factors such as tariffs, securing the border, and a hawkish shift in Treasury net financing (i.e., less bills + more coupons) are likely to contribute negative supply shocks to the economy and asset markets. At the same time, tax cuts, deregulation, and accelerated energy production could generate positive supply-side shocks.

Investors should closely monitor the size, sequence, and scope of these policy changes, as they will have a significant impact on asset markets throughout 2025. If enough of the left-tail risk economic scenarios materialize, we believe it is likely to lead to a crash in risk assets.

2. What Is The Outlook For Inflation?

At 42 Macro, we conducted an econometric study of all the postwar economic cycles in and around recession. That process consisted of normalizing the policy, profits, liquidity, growth, stocks, employment, credit, and inflation cycles, and comparing current trends to historical patterns late in the business cycle, leading into, and through a recession.

In that study, we found that inflation is the most lagging indicator of the business cycle, as it usually breaks down below trend 12 to 15 months after a recession starts.

According to our GRID Model projections for Headline CPI and the deep dive study referenced above, US inflation is unlikely to return durably to trend in the absence of a recession, which implies the highest probability outcome is inflation firming over the medium term against easing base effects. Per our GRID Model, late-Q2/early-Q3 is when inflation is likely to accelerate appreciably enough to cause serious problems in asset markets.

3. What Does The 42 Macro Positioning Model Reveal About Current Risks To Asset Markets?

Our 42 Macro Positioning Model analyzes 15 long-term time series, comparing their current levels to the median values observed at major bull market peaks and troughs.

Currently, many of the time series we track are breaching levels that have consistently been observed at major bull market peaks:

- AAII stock allocation exceeds the median value observed at major bull market peaks in the nine market cycles since Jan-98.

- AAII bond allocation is nearing the low level typically observed at major bull market peaks.

- AAII cash allocation is below the median value observed at major bull market peaks.

- S&P 500 realized volatility—an inverse proxy for systematic fund exposure—is nearing the level seen at prior bull market peaks.

- S&P 500 implied volatility correlations—an inverse proxy for market-neutral hedge fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 price/NTM EPS ratio sits in the 92nd percentile of all historical data, dating back to the late 1980s, and is well above the median value observed at major bull market peaks.

- Investment-grade credit spreads are in the 2nd percentile of all historical data, also dating back to the late 1980s, and are well below the median value observed at major bull market peaks.

These metrics collectively signal a positioning cycle that is highly asymmetric, with participants who are bullish and are heavily betting on positive outcomes across growth, inflation, policy, and liquidity.

As previously stated, if enough of the left-tail risk economic scenarios materialize in succession, combined with the extreme bullish condition we currently observe in the positioning cycle, we believe it is likely to lead to a crash in risk assets.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +185%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Will Gold Protect Your Wealth Better Than Bonds Over The Long Term?

Darius recently joined Gavekal’s David Hay to discuss the current Fourth Turning, #inflation, the relative attractiveness of Treasury Bonds and Gold, and much more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. How Can Understanding Fourth Turning Economic And Policy Dynamics Help Investors Position Their Portfolios?

At 42 Macro, we conducted a deep-dive empirical study on Fourth Turnings to identify trends across economic, market, and policy indicators during these transformative periods.

Our research revealed that Fourth Turnings are consistently marked by explosive growth in sovereign deficits, rising debt levels, expanding government size, and soaring costs of financing deficits. These periods also see a sharp deterioration in sovereign fiscal balances—a trend already unfolding in the current Fourth Turning.

As investors, understanding how these indicators are likely to behave during Fourth Turnings is essential to properly positioning your portfolio and staying on the right side of market risk.

2. How Does Inflation Typically Behave In Fourth Turnings?

Our analysis of Fourth Turnings reveals that Democrats have historically emphasized government social benefits to supplement household incomes, while Republicans have prioritized lowering corporate tax rates. These opposing approaches have converged to fuel the accumulation of significant public debt.

We foresee the Federal Reserve is likely to be drawn into the equation, effectively forced to monetize rising public sector debt and deficits.

We believe the explosive growth of public sector debt plus the Fed’s likely choice to monetize a considerable portion of that debt is likely to catalyze sustainably above-trend rates of inflation, aligning with our research that indicates inflation tends to accelerate sharply during Fourth Turnings.

3. How Can Investors Best Protect Their Wealth Against Explosive Growth In Sovereign Debt And Sustainably Above-Trend Inflation?

Our KISS Model Portfolio is our systematic trend-following strategy designed for retail investors, with a core allocation of 60% Stocks, 30% Gold, and 10% Bitcoin.

Recently, we pivoted from Treasury Bonds to Gold, which we believe is a better choice for investors in the context of the current Fourth Turning. Gold has consistently performed well across various Market Regimes, serving as a reliable hedge against inflation and economic uncertainty—particularly during Fourth Turnings, when sovereign debt and inflation tend to surge.

Since our bullish pivot in November 2023, the QQQs have surged 40% and Bitcoin is up +174%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it’s time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just macro insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Will AI Replace Humans In Investing?

Darius recently hosted QuAIL Technologies CEO Andrew Fischer on this month’s 42 Macro Pro to Pro, where they took a deep dive into AI’s future impact on the financial services industry.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Will AI Replace Investment Professionals?

While many financial services professionals fear this, Andrew believes AI will not replace them. Instead, it will become a powerful tool every investor uses in some form.

Common applications of AI include accelerating workflows and increasing productivity by enhancing systems like report generation and client-stakeholder communication. AI’s ability to analyze vast amounts of data gives humans a competitive edge.

AI will not replace people; rather, people using AI will replace those that do not.

2. How Will AI Impact Investors’ Lives?

Andrew Fischer shared a compelling example from QuAIL Technologies, where AI is used daily to help investors manage the overwhelming volume of information they encounter.

Each morning, QuAIL’s AI agents analyze around 5,000 articles—well before they have had their first cup of coffee.

Humans can not realistically process that many articles in such a short time nor retain or act on the insights while they are still relevant. But with AI, investment professionals can quickly access refined, relevant insights from thousands of sources. This means that by the start of their day, they already understand the latest fundamental and technical developments and their potential impact on their portfolios, giving them a strategic edge over other market participants.

3. How Can AI Enhance Repeatable Investment Processes?

One area where AI shows significant promise is in assisting the process of identifying Market Regimes. Andrew has explored concepts like geometric fractals and statistical self-similarity – research that suggests that the factors defining each regime can change over time. By incorporating AI, investors can track these shifts in explanatory variables, continuously adjusting the models used to capture these evolving patterns.

AI also helps investors ensure they are focused on the most predictive factors for identifying market regimes. With AI, a system can iterate and refine its understanding of market dynamics.

Since alpha naturally decays over time, this continuous improvement and stress-testing of models is essential. AI can play a transformative role in streamlining such procedures, thus preserving and enhancing our and every investor’s investment approach.

Since our bullish pivot in November 2023, the QQQ has surged nearly 30%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it’s time to explore our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” signals that have a proven track record of keeping your portfolio on the right side of market risk.

Thousands of investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass. No catch, just macro insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

To Survive The Fourth Turning, You Must Listen To The Market

Darius sat down with our friend Charles Payne on Fox Business last week to discuss the impact of the Fourth Turning on the economy and asset markets.

If you missed the interview, here is the most important takeaway from the conversation that has significant implications for your portfolio:

During This Fourth Turning, Public Debt Growth Is Likely to Vastly Exceed Current Projections. The Only Institution With A Balance Sheet Large Enough to Finance This Is The Federal Reserve—And They Will.

- Income inequality typically breaks down during a Fourth Turning, driven by wealth redistribution through populism. We believe this trend is likely to persist throughout this Fourth Turning.

- We believe global liquidity is likely to increase over the medium term. The Federal Reserve is cutting policy rates despite Super Core inflation remaining 200 basis points above their target, showcasing their asymmetrically dovish reaction function. Combined with our ‘Resilient U.S. Economy’ theme, which we authored in September 2022, we see strong potential for upside in asset markets over the medium term.

- During a Fourth Turning, it is generally wise for investors to long risk assets such as stocks, credit, crypto, commodities, and gold. Additionally, we recommend investors avoid large positions in Treasury bonds, as we believe inflation is likely to remain persistent and growth relatively stable.

That said, risk assets will NOT appreciate throughout the Fourth Turning in a straight line. There will be significant drawdowns to risk manage along the way – perhaps as painful as the Dot Com Bust, GFC, or COVID crash.

Fortuitously, 42 Macro clients have access to our KISS Model Portfolio and Discretionary Risk Management Overlay aka “Dr. Mo” to help them successfully navigate their portfolios throughout these increasingly trying geopolitical times.

By now, you’ve likely realized that piecing together an investment strategy from finance podcasts, YouTube videos, and macro “gurus” on 𝕏 is not delivering the results you know you deserve.

This kind of approach only leads to confusion from conflicting advice, frustration from mediocre returns, and exhaustion from the emotional rollercoaster of your portfolio swings.

If you don’t change your process, how can you expect to get better results?

Over 2,000 investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just macro insights to help you grow your portfolio—our way of saying thanks for being part of the 42 Macro universe.

What Will The Future of AI Hold?

Darius recently hosted our friend Beth Kindig on 42 Macro’s Pro to Pro, where they discussed the outlook for the Tech and Communication sectors, how companies will benefit from AI, the scale of AI as an investment opportunity, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Are The Tech and Communication Services Sectors Overvalued?

Our research shows that the valuations of the Tech and Communication Services sectors, when combined, are comparable to levels seen during the dot-com bubble.

At 42 Macro, we monitor metrics such as the trailing 12-month price-to-earnings (P/E) ratio, price-to-sales ratio, and the combined market cap of these sectors as a share of total S&P 500 market cap.

While the current earnings and cash flow generation of these companies make a return to the extreme P/E levels of the dot-com bubble unlikely in the medium term, we have already exceeded the peak price-to-sales ratio and their share of the overall S&P 500 index from that period. This suggests that while earnings may provide some cushion, valuation pressures remain elevated compared to historical benchmarks.

2. How Will Firms Become More Profitable Through The Implementation of AI?

Estimates from McKinsey and Gartner indicate that AI will generate $4.4 trillion in global profits. But where will these profits come from?

One example, highlighted by Beth Kindig, is Klarna, the buy-now-pay-later unicorn valued at around $7 billion. Klarna recently announced plans to eliminate Salesforce and Workday from their tech stack by developing custom large language models tailored to their needs.

Beth estimates the custom models might cost them between $3 to $7 million, compared to the tens of millions they would spend on Salesforce and Workday subscriptions. By integrating custom AI solutions and cutting out those expensive software products, Klarna will likely become more profitable.

3. Is AI A Better Investment Opportunity Than The Internet?

The internet is open-source and highly democratized, allowing anyone to create a website easily.

AI, however, is the opposite. It is proprietary, with companies owning their large language models. The barrier to entry for AI is extremely high, unlike the internet, where it is nearly nonexistent.

Training an LLM is costly, and the scarcity of GPUs makes success in AI challenging. This creates a winner-takes-all environment where early movers gain a significant competitive edge. Investing in AI today presents a rare opportunity to benefit from a high-barrier-to-entry industry with massive growth potential and the power to shape entire sectors for years to come.

By now, you’ve likely realized that piecing together an investment strategy from finance podcasts, YouTube videos, and macro “gurus” on 𝕏 is not delivering the results you know you deserve.

This kind of approach only leads to confusion from conflicting advice, frustration from mediocre returns, and exhaustion from the emotional rollercoaster of your portfolio swings.

If you don’t change your process, how can you expect to get better results?

Over 2,000 investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to join them, we are here to support you.

When you sign up, you’ll get immediate access to our premium research and signals—and if we’re not the right fit, you can cancel anytime without penalty.

The 42 Macro Investment Process

Darius joined our friend Tony Sablan on the Unscripted Arena podcast to discuss Darius’ unique background, the 42 Macro risk management process, overcoming cognitive biases in investing, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Stop Relying On Predictions If You Want To Make Money In Financial Markets

Making money in asset markets is not about predicting future developments in the economy. It is impossible to generate consistently accurate forecasts for every relevant growth, inflation, and policy catalyst, across economic cycles. Moreover, any investor who believes they can accurately forecast the future with enough precision to position for each meaningful surprise in the data relative to consensus expectations is either a newsletter-writing charlatan or someone who has succumbed to the Illusion of Validity.

Instead, making and saving money in asset markets is about positioning yourself on the right side of market risk, which equates to being long assets that are trending higher and short or out of assets that are trending lower.

An overwhelming focus on predicting the future will only hinder your ability to respond to critical inflections in momentum with enough speed and confidence to manage risk consistently and effectively. You don’t have to predict things like “liquidity”, “flows”, etc. to benefit from trends and inflections in those cycles, just as long as you remain disciplined about your risk management process.

2. Investors Should Position According To The Current Market Regime

The 42 Macro Risk Management Process simplifies complex market dynamics into a clear and straightforward three-step approach:

- Identify and position for the Market Regime

- Prepare for regime change using quantitative signals with our Macro Weather Model

- Prepare for regime change using qualitative signals via our fundamental research

Since mid-November, we have remained in a risk-on Market Regime, currently REFLATION. That means you should have been overweight risk assets like stocks, credit, commodities, and crypto and underweight defensive assets like Treasury bonds and the US dollar every day since.

As an institutional investor, you should also understand the key portfolio construction considerations for each Market Regime. If you need help understanding these critical factor tilts, we are here to help.

3. Our Macro Weather Model Systematically Nowcasts Momentum Across The Principal Components of Macro

The Macro Weather Model is our process for analyzing several principal components of macro and translating those components into a 3-month outlook for major asset classes, including stocks, bonds, the dollar, commodities, and Bitcoin.

This model monitors indicators that reflect both the real economy cycles and financial economy cycles:

- Real economy cycles: growth, inflation, employment, corporate profits, and fiscal policy

- Financial economy cycles: liquidity, credit, interest rates, and market sentiment indicators ‘fear’ and ‘greed.’

Currently, the Macro Weather Model suggests a bearish three-month outlook for stocks and bonds, a neutral three-month outlook for commodities and Bitcoin, and a bullish three-month outlook for the US dollar. In totality, our Macro Weather Model currently suggests the Market Regime has a moderate risk of experiencing a RORO phase transition (i.e., risk-on to risk-off, or vice versa) to a risk-off Market Regime within three months.

That’s a wrap!

If you found this blog post helpful, explore our research for exclusive, hedge-fund-caliber investment insights you can act on today.

Is There Further Upside Risk In Asset Markets?

Darius joined David Hunter last week on our Pro to Pro Live to discuss the 42 Macro Positioning Model, the outlook for asset markets, our “Green Shoots Globally” theme, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Our Positioning Model Suggests There Is Likely Additional Risk To The Upside Over The Medium Term

Bears have found themselves reluctant to join the recent rally in equities.

Our 42 Macro Positioning Model monitors the aggregated non-commercial net length as a percentage of total open interest in the combined futures and options markets for US Equities. Currently, this indicator sits in the 33rd percentile of readings, notably lower than the median reading of the 62nd percentile seen at major bull market peaks.

Despite the significant market rally, we have yet to witness the structural upside capitulation characteristic of bull market peaks. This absence suggests there is likely potential for further upside over the medium term, although there may be a correction in the near term.

2. Cash On The Sidelines Stays On The Sidelines Until There Are Reasons For It To Exit

Currently, over $6 trillion is parked in money market funds.

Our analysis, spanning the last four cycles—2020, 2008, 2001, and 1991 —reveals a consistent pattern: cash on the sidelines tends to stay put in these funds until after a crash, recession, and rate cuts have each taken place.

We anticipate this cycle will follow suit, with the bulk of cash on the sidelines staying put until these pivotal events unfold.

3. “Green Shoots Globally” Continues To Support Risk Assets

In January, we authored our “Green Shoots Globally” theme that was supportive of asset markets.

The theme persists, as our models show that every major economy in the world has a Composite PMI trending higher—a bullish leading indicator suggesting what is likely to occur over the next three to six months from an economic standpoint.

Moreover, we track the number of industries reporting growth in the ISM Manufacturing survey. In December, that number bottomed. Our backtests have found that in the year following the bottom, the S&P generates a median return of 28%. While this is just one data cyclical framework to respect, it strongly suggests that the broadening of market breadth stemming from improving global fundamentals is likely to continue.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

What Will Push Powell to Cut?

Darius joined Maggie Lake on Real Vision’s Daily Briefing this week to discuss the resiliency of the US economy, Immaculate Disinflation, Bitcoin, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. The US Economy Remains Resilient

In September 2022, we authored our “Resilient US Economy” theme, and the prevailing data today continues to support this narrative.

Furthermore, our research indicates that the Fed is likely to implement easing monetary policies over the medium term. This confluence of factors—a robust economy operating at or above trend coupled with supportive monetary measures—has fostered a bullish environment for asset markets.

We believe asset markets are likely to continue performing well until either our “Resilient US Economy” theme dissipates or the “Immaculate Disinflation” theme concludes, forcing the Fed and Treasury to officially pivot to hawkish forward guidance and net financing policy.

2. Recent Labor Market Data Indicates Evidence of Sticky Inflation

The Feb JOLTS report confirmed that “Immaculate Slackening” persists, but investors should be worried by the apparent bottoming in turnover:

- The Private Sector Hires Rate ticked up from its cycle low to 4.1%

- The Private Sector Quits rate remained unchanged at 2.4%

An increase in employee turnover could disrupt the “Immaculate Disinflation” narrative. Because workers who change jobs tend to have faster wage growth, the bottoming in these indicators suggests that we may be running out of steam concerning the disinflation we have observed in wages.

Despite the February JOLTS report supporting sticky inflation, we continue to believe the “Immaculate Disinflation” theme is likely to persist for another quarter or two.

3. Bitcoin’s Current Correction May Worsen If The “Immaculate Disinflation” Narrative Dissipates

After rallying 75% from Feb 1st to March 10th, Bitcoin is currently in a consolidation period.

We anticipated this pullback. Over the past month, we have highlighted several extended tactical positioning indicators in our positioning model to our clients, such as the AAII Bulls Bears Spread and AAII survey, that suggested markets were likely overbought.

If the “Immaculate Disinflation” narrative loses steam, the current correction could deepen. If that occurs, investors would need to pull forward their timeline expectations of a transition from a risk-on REFLATION Market Regime to a risk-off INFLATION Market Regime.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

A Glimpse Into Bitcoin

Darius joined Dylan LeClair last week to discuss the outlook for Bitcoin, how it fits into the 42 Macro KISS Model Portfolio, ETF flows, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Understanding The Correlation Between Bitcoin’s Price And Volatility Is Crucial to Grasping The Dynamics of The Asset Class

Our research at 42 Macro indicates that although equities and fixed income are generally inversely correlated to volatility, Bitcoin tends to be positively correlated to its historical and implied volatility.

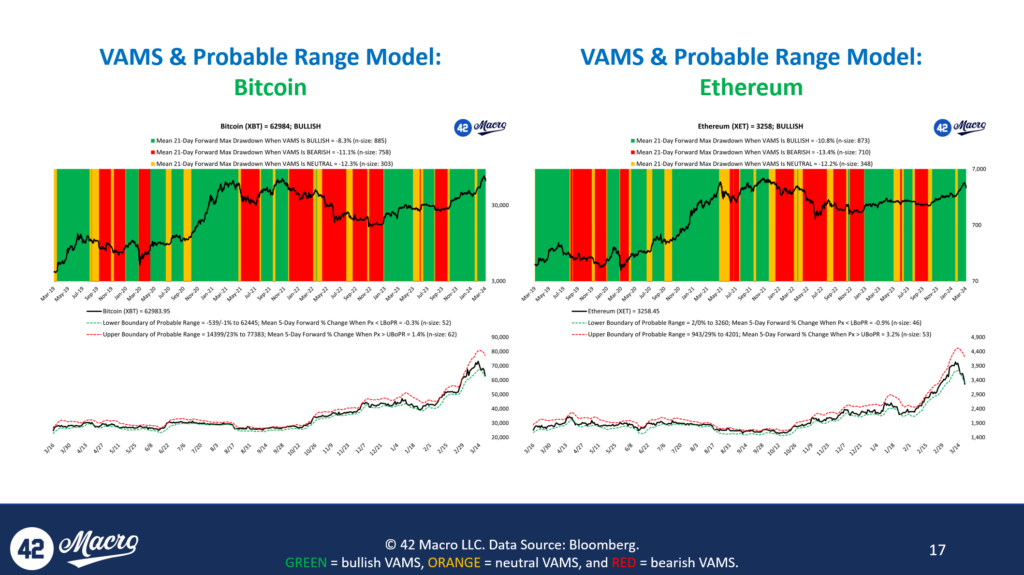

Moreover, our 42 Macro Volatility Adjusted Momentum Signal (VAMS) scores volatility relative to price to determine whether an asset is bullish, bearish, or neutral.

Following our VAMS signals has allowed our clients to be on the right side of market risk and remain long during Bitcoin’s large upswings this year. Investors who plan to add Bitcoin to their traditional multi-asset portfolio would be well advised to understand the correlation between Bitcoin’s price and volatility to ensure they are positioned for its large, volatile moves. At 42 Macro, we can help you do exactly that.

2. Investors Can Prudently Gain Exposure to Bitcoin Through The KISS Model Portfolio

Our KISS Model Portfolio, a 60/30/10 trend-following approach, helps clients gain exposure to Bitcoin from legacy strategies such as the traditional 60/40 portfolio.

The current allocation of our KISS Model Portfolio, determined using our Global Macro Risk Matrix and VAMS for dynamic position sizing, is 10% in Bitcoin, 60% in SPY, 15% in AGG, and 15% in USFR.

Although we have a positive outlook on Bitcoin’s future performance, mere belief is not sufficient to allow us to take a position. Our decision-making process relies on signals derived from the current market regime and signals from our VAMS. At 42 Macro, we help investors make money and protect gains in financial markets, and it is through strategies like KISS that we have empowered our clients to achieve these objectives.

3. The 2024 Bitcoin ETF Inflows Have Far Exceeded Expectations

The immediate success of the Bitcoin ETF out of the gate has been remarkable.

IBIT has been the most successful ETF launch in history, gaining an impressive $15 billion in AUM in the first two months.

However, Dylan informed our audience that the current demand for Bitcoin has primarily originated from Blackrock, Fidelity, and other institutional investors. Additionally, ETF issuers have indicated that the current buyers of BTC ETFs do not represent some of the largest pools of capital; those significant investors have yet to enter the market. As a result, we anticipate a fresh surge of capital inflows into the asset class in the coming quarters, which is poised to drive prices even higher.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

Bitcoin, Stocks All-Time Highs: Remain Bullish?

Darius joined Anthony Pompliano last week to discuss the outlook for inflation, global liquidity, asset markets, and more.

If you missed the interview, here are the three most important takeaways from the conversation that has significant implications for your portfolio:

1. The February CPI Report Showed Signs of Sticky Inflation

The February CPI report did incremental damage to the immaculate disinflation narrative.

Headline CPI accelerated to 3.9% on a three-month annualized basis, more than double its pre-covid trend. The spike was largely driven by an acceleration in Energy CPI to 4.5% on a three-month annualized basis.

Moreover, Core CPI accelerated to 4.1% on a three-month annualized basis. The increase was largely driven by Services CPI, which remained at 6.0% on a three-month annualized basis, and Super Core CPI, which accelerated to 6.7% on a three-month annualized basis, more than triple its pre-Covid trend.

2. The February NFIB Small Business Optimism Survey Supported The Soft Landing Scenario

The February NFIB Small Business Optimism survey, a monthly survey that provides insights into the confidence levels and outlook of small business owners, indicates that inflation may continue declining over the medium term.

The sub-indices of the survey, including the Higher Prices, Price Plans Next Three Months, Compensation, and Compensation Plans indices, all slowed sequentially and are at multi-year lows.

These readings suggest that although we see signs of sticky inflation in the CPI and PCE Deflator reports, stickiness is likely to be transitory and that inflation will resume its downtrend over the medium term.

3. Global Liquidity Is Likely to Continue Trending Higher Over The Next One to Two Quarters

The monetary policies implemented by the PBOC this year have been very positive for global liquidity. Additionally, China recently revealed ambitious economic targets for 2024, aiming for a 5% GDP growth, the creation of over 12 million jobs, and a 3% inflation rate. To meet these aggressive economic targets, the PBOC will likely continue easing policy, and that is likely to continue supporting global liquidity.

Moreover, several key countercyclical drivers of global liquidity have supported liquidity creation in the private sector.

The dollar, bond market volatility, and currency market volatility have all trended in directions that support private sector liquidity creation, and we believe these trends are likely to continue over the next quarter or two.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!