Welcome to The Weekly!

This past week’s market action reinforced just how much uncertainty there remains surrounding U.S. monetary policy. Cross-asset volatility surged following the nomination of Kevin Warsh for Fed Chair, a development that boosted the dollar and reversed crowded positioning in precious metals and levered bets on cryptocurrencies predicated on expectations of durable Fed debt monetization.

Warsh’s reputation as an aggressive inflation hawk — and his long-standing criticism of quantitative easing — has intensified speculation around balance sheet contraction and the durability of liquidity support. Warsh has vocally criticized his former colleagues at the Fed for allowing asset holdings to swell, fueling market speculation that a Warsh Fed would oversee a substantial shrinking of the balance sheet.

Meanwhile, Treasury Secretary Scott Bessent’s incremental endorsement of dovish net financing policy remains a key pillar supporting the 42 Macro Paradigm C bull market, even as uncertainty around the Fed’s role in supporting fiscal dominance reaches an all-time high.

All the same, growing cracks in legacy software stocks added further evidence in support of our Jobless Recovery thesis, as AI-driven efficiency gains and competitive pressures continue to disrupt labor demand. Crypto markets likely marked a capitulation low, but Warsh’s nomination may represent a durable headwind to non-Bayesian narratives underpinning the asset class.

In an environment this uncertain, now is not the time to be a hero. This is the moment to trust your risk management process or partner with a team that can meaningfully enhance it.

In Case You Missed It

What Does The Breakdown in Legacy Software Stocks Signal About the US Labor Market?

Enjoy Tuesday’s Macro Minute in which we explain why the breakdown in legacy software stocks is reinforcing 42 Macro’s Jobless Recovery thesis, as AI-driven disruption erodes once-defensible business models and pressures labor demand.

While firms continue to hoard experienced workers, hiring for younger and less-tenured cohorts is deteriorating, masking underlying labor market weakness.

Charts of the Week

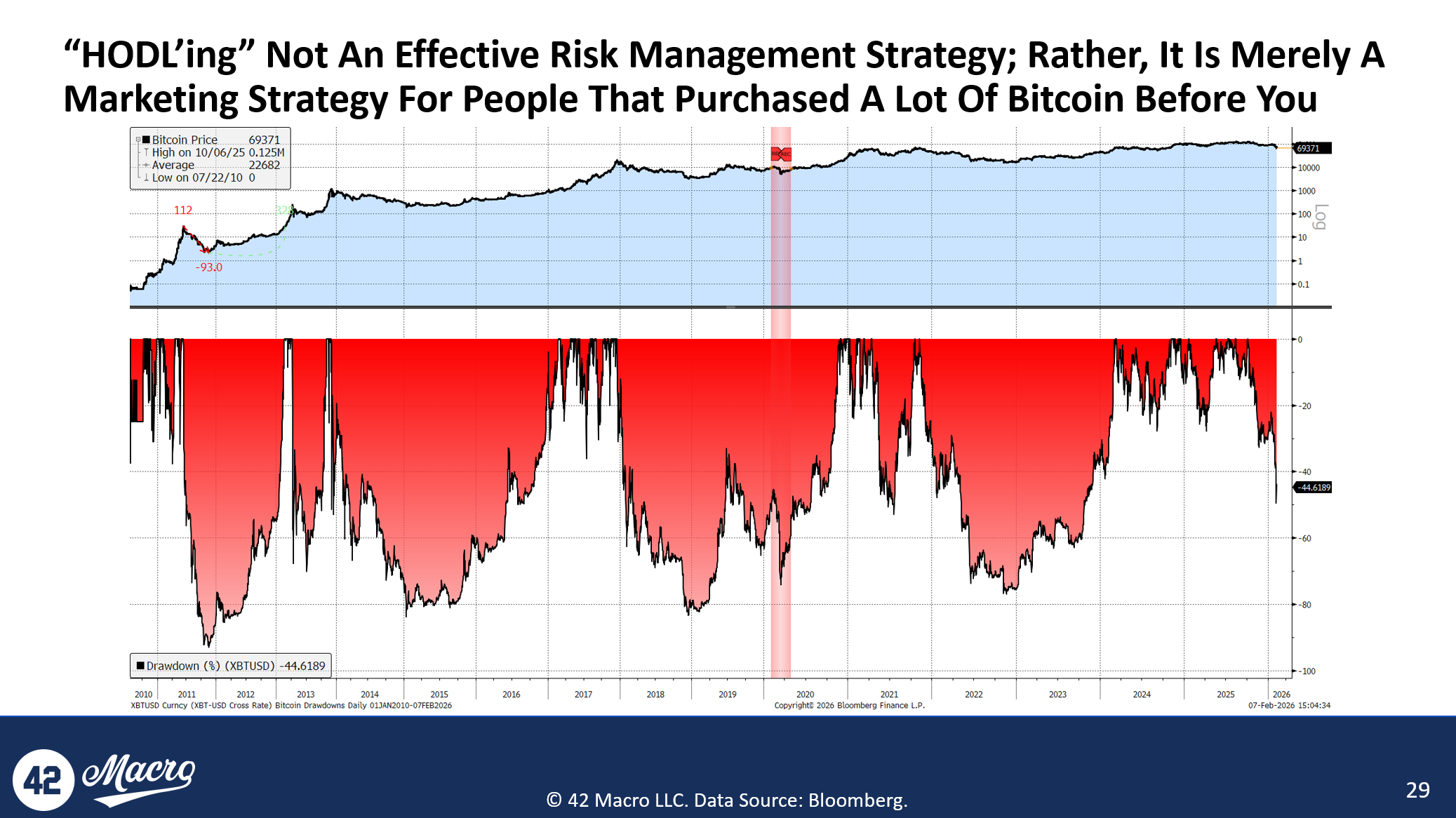

“HODL’ing” Is Not Effective Risk Management

We hope this latest halving in the price — not supply — of Bitcoin highlights why “HODL’ing” is not a substitute for an effective risk management strategy.

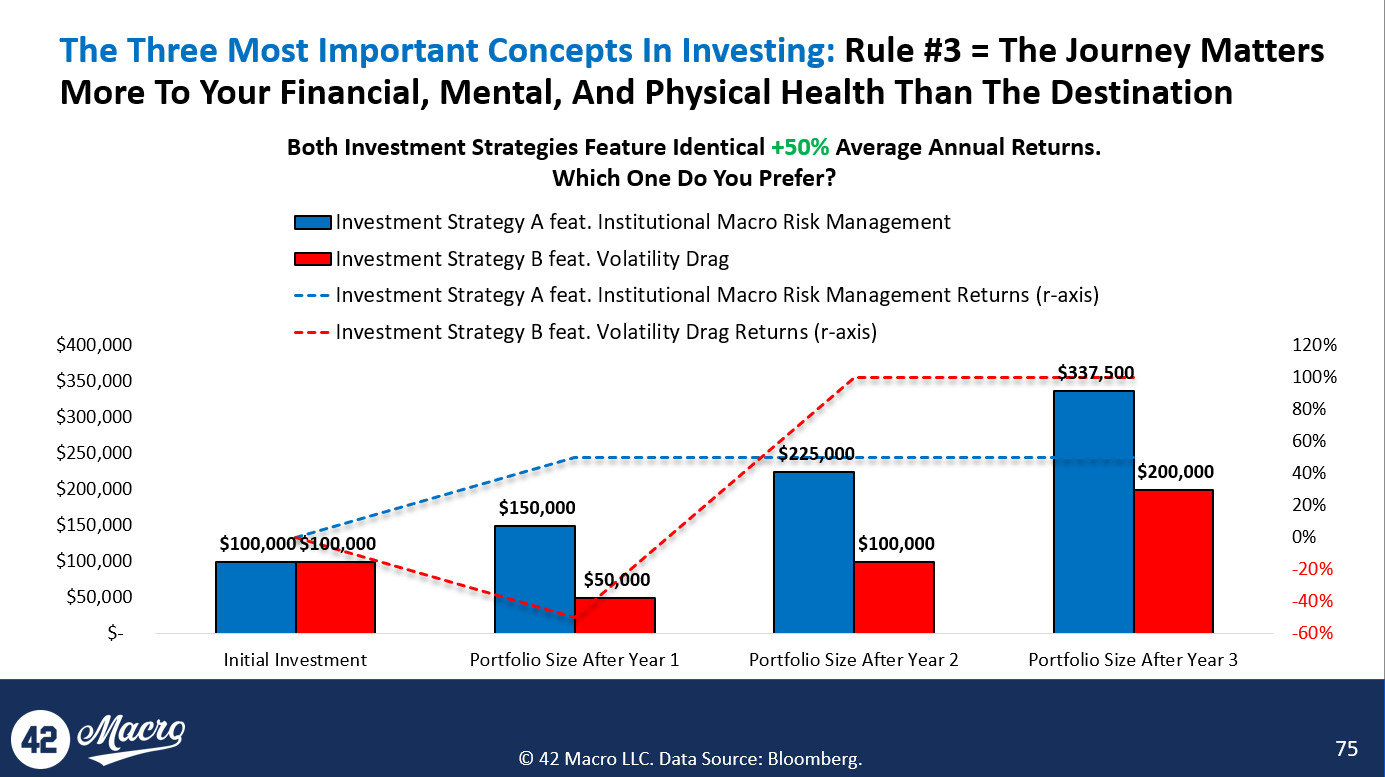

Volatility is part of the journey for any investment, but navigating it successfully requires process and discipline.

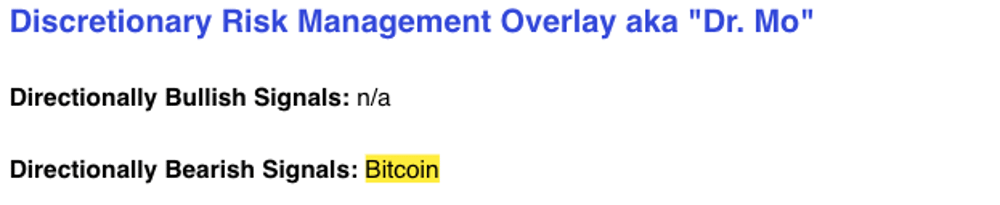

Successful Signals From Dr. Mo

On October 30th, 2025, our Discretionary Risk Management Overlay signaled a bearish breakdown in Bitcoin. Since the pivot, Bitcoin has depreciated -36%, with a max drawdown of -50%.

Community Spotlight

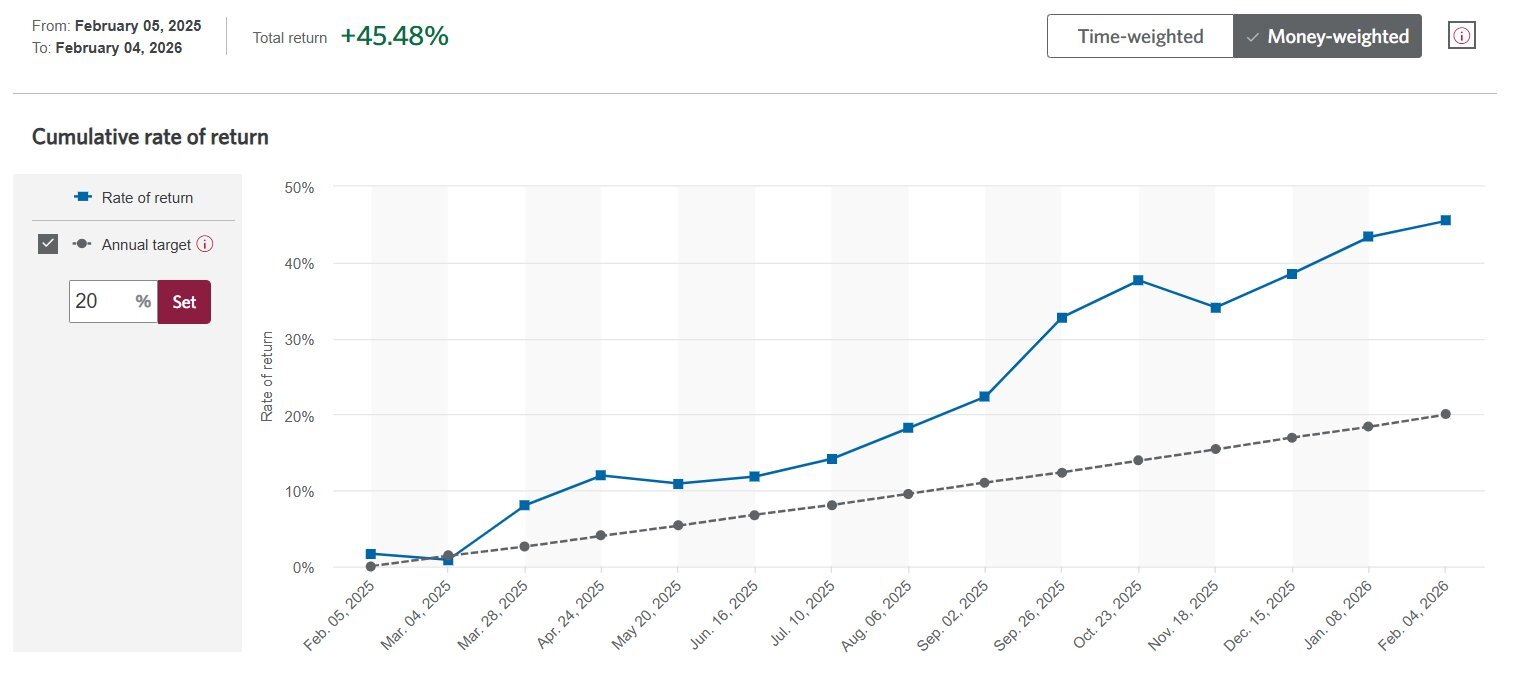

This week, we’re excited to share feedback from a member of our global investor community. Specifically, the results that come from incorporating 42 Macro’s risk management overlay to your investment process.

It’s gratifying to see KISS and Dr. Mo create so many positive outcomes for investors around the world. Thank you!

Parting Shot | Bounded Rationality

Markets don’t overwhelm investors because the data is unknowable. They do because time, attention, and certainty are limited.

Behavioral economists call this bounded rationality: even smart decision-makers can’t process everything at once. When volatility rises and narratives collide, judgment shortcuts creep in and risk management breaks down.

Learn how our Discretionary Risk Management Overlay aka Dr. Mo helps investors stay systematic when it matters most.

EXPLORE 42 MACRO RESEARCH