Darius sat down with Markets Policy Partners last week to discuss the details behind a number of 42 Macro models, inflation, and more.

If you missed the interview, here are three takeaways from the conversation that have significant implications for your portfolio:

1. A Look Into How 42 Macro Nowcasts The Current Macro Regime

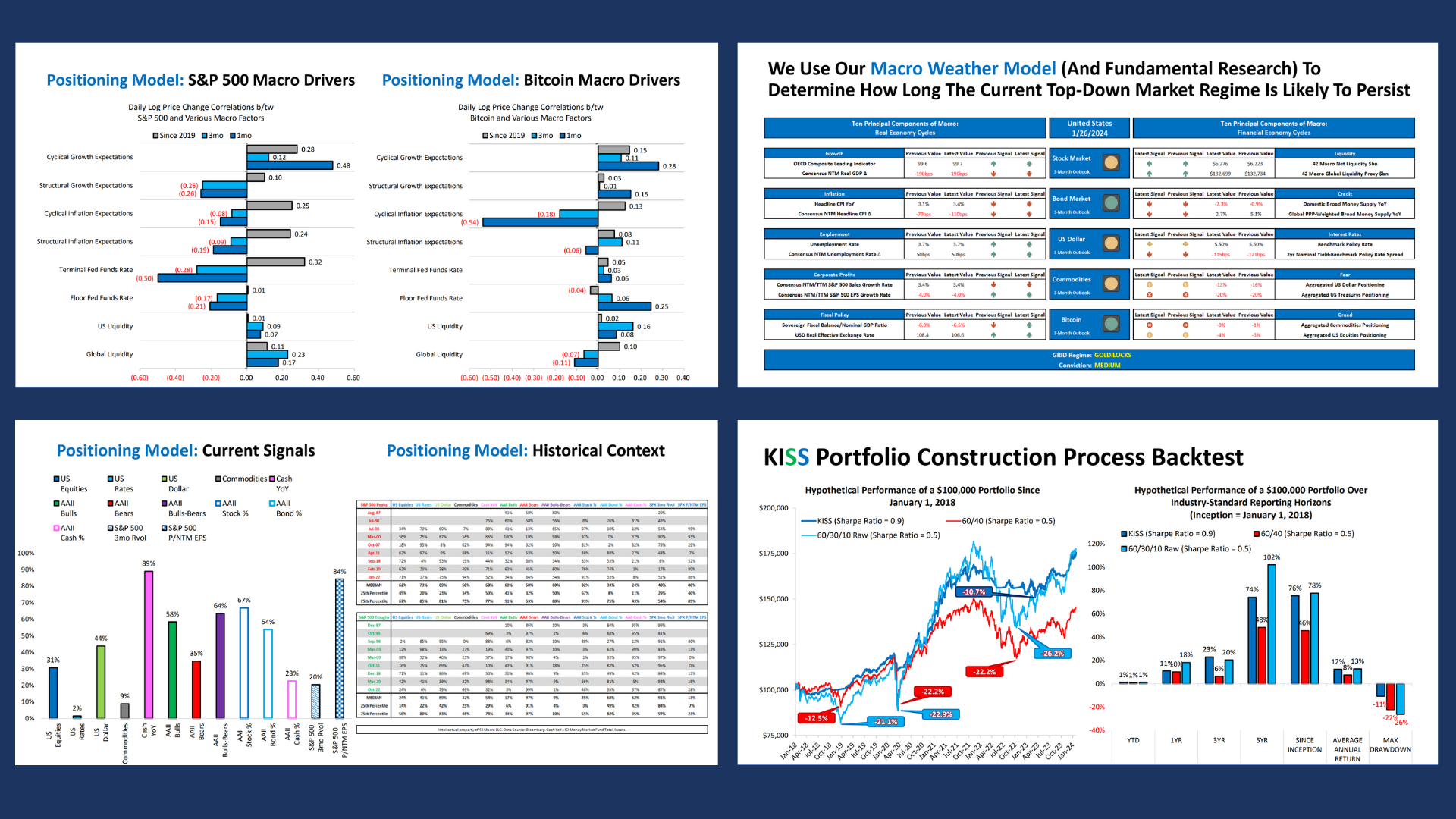

Our Global Macro Risk Matrix is designed to provide a current snapshot of the market regime from a top-down perspective.

This is important for investors because in order to be consistently profitable, they should align their positioning with prevailing market conditions.

Our process evaluates 42 distinct markets, including broad baskets of assets such as equities, volatility instruments, commodities, currencies, and various fixed-income measures like rates, spreads, and yields, and incorporates a volatility-adjusted momentum signal to assess each market’s performance.

We update the data daily and aggregate the scores for each market.

Finally, the regime that accumulates the highest total score is identified as the prevailing top-down market regime.

2. Our Macro Weather Model Systematically Nowcasts Momentum Across The Principal Components of Macro

Understanding the current macro regime is just the starting point.

To be successful, investors must also anticipate the duration of the current market regime and anticipate the transition to the subsequent market regime – especially when a “RORO” phase transition (i.e., risk-on-to-risk-off or vice versa) is increasingly likely.

The Macro Weather Model is our process for analyzing several principal components of macro and translating those components into a 3-month outlook for major asset classes, including stocks, bonds, the dollar, commodities, and bitcoin.

This model monitors indicators that reflect both the real economy cycles and financial economy cycles:

- Real economy cycles: Growth, inflation, employment, corporate profits, and fiscal policy

- Financial economy cycles: Liquidity, credit, interest rates, and market sentiment indicators ‘fear’ and ‘greed.’

3. Our Models Indicate Inflation Will Likely Trend 100 to 140 Basis Points Higher This Decade Compared to The Previous One

Since 2020, most forecasting models used on Wall Street, including DSGE and auto-regressive models, faced significant challenges in predicting inflation due to such an unprecedented surge in various economic indicators stemming from the COVID-19 pandemic.

During the decade from 2010 to 2019, core PCE maintained an underlying trend of approximately 1.6%.

However, our models predict that Core PCE will likely average somewhere between 2.6% to 3.0% throughout the 2020-2029 decade.

An increase to those levels is likely to cause concern for the Fed and may lead to structural policy adjustments in the future.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!